Difference between revisions of "Call Routing"

(Created page with "=Introduction= 500px Effective workforce management requires a detailed understanding of call routing strategies in place in any call center operation...") |

(No difference)

|

Revision as of 12:20, 23 March 2014

Contents

Introduction

Effective workforce management requires a detailed understanding of call routing strategies in place in any call center operation. Without an effective understanding of call routing principles, and their impact on workforce management, large inefficiencies can be easily lost, with customers paying the price through longer wait times and potentially being routed to the wrong agent groups. Through my career, I have always maintained a tight connection between routing principles and workforce management strategies to ensure smooth call center operations.

Creating a positive customer experience was always my primary goal while working at Southern Division Customer Care organization. With the majority of all customer interactions conducted via the phone, establishing the optimal routing to match the right customer to the right resource at the right time was critical in achieving this goal.

The Southern Division continues to leverage skills-based routing to maximize agent utilization across call centers. In 2010, through Call Sharing Practices, the Southern Division leveraged skills-based routing across multiple call centers to expand the maximization of agent resources. Agents who could handle similar call types across multiple geographic areas were skilled to handle additional calls when available, with each call center "backing up" other call centers with the same billing platforms.

For improved customer service, however, opportunities exist to establish more sophisticated and flexible routing strategies that match the right agent against the customer. The Southern Division ROC will refer to this next level of capability as Advanced Skills-Based Routing or ASBR. In advanced skills-based routing, we will look to leverage attributes obtained by the UIVR to drive routing decisions which leverage our established skills-based routing.

Advanced Skills-Based Routing: Non-Payment Customers

The Southern Division's initial deployment of ASBR will be targeted at non-pay customer call traffic. This call type is defined as a customer who calls in response to their services being interrupted due to non-payment of services. This non-pay traffic had historically been defined by the following set of characteristics:

- Arrival patterns which are difficult to forecast/staff, causing service level challenges

- Disinterested billing reps when routed internally

- No consideration for caller attributes

- 3rd Party quality; collect & repeat

- Churn risk

- Non-Standardized routing logic (pushing regular bill traffic w/ collections)

- Non-standardized process – Driving continued bad behavior (promise to pays, repeat calls)

In response, the Southern Division is currently deploying a "Payment Assistance Center". This center will initially consist of 2 teams of 12 agents, 24 in total, who will be dedicated to handling only non-payment call traffic. In addition to a specialized team, the Southern Division will leverage this team to introduce Advanced Skills-Based Routing to deliver customer attributes from the UIVR to drive routing decisions within the Avaya.

ASBR Goals for Non-Payment Traffic

The deployment of a specialized "Payment Assistance Center" with the introduction of ASBR is designed to target improvements in 4 areas:

Revenue Generation

- Improved revenue through intelligent customer treatment based on profile

- Consistent approach, standardized M&Ps to maximize revenue collection

- CAE incentives tied to revenue collection

Retention

- Strategic approach for high value customers

- Educate customers to minimize future interruption

- Differentiate true “collections” customer from legitimate customer issues

Cost Reduction

- Remove highly variable traffic from call center operations

- Expense reduction through single point of forecasting and scheduling ownership

- Low-end customer treatment strategies to drive savings

Quality

- Standardized approach and training

- Intelligent advanced skills-based routing applied to customer treatment

- Professional collections leadership

Non-Payment Customer Segments

The ASBR Non-Payment logic creates a dynamic score for each non-pay customer exiting the UIVR. This score identifies three attributes and applies a formula for segmenting traffic in real-time. The attributes are:

- Tenure (0 to 12 months in initial release)

- Monthly Recurring Charge (most recent)

- The # of Times Delinquent (future state would = number of times in non-payment status)

The goal in the formula applied is to create segmentation which allows us to differentiate a "premium" customer, one who has the highest % of on-time history plus the highest recurring charges from a "Outsource" customer, one who continually pays late and has a low recurring payment.

Establishing A Non-Payment Scoring Formula

The Headcount Attribute Routing Calculator was developed to apply an equation to introduce attribute routing based on bill payment history. This tool was specifically designed to model "what-if" scenarios for creating a scoring index to introduce routing decisions for non-pay customer service traffic.

The following formula was utilized against a sample of 12,796 calls processed by the UIVR to determine the break-out of customer segments after the score was applied.

Index score = ((SxSW)+(TxTW))/((L)x(1/LW))

Where;

- S = Spend per Month

- SW = Spend Weight

- T = Tenure

- TW = Tenure Weight

- L = Late (or number of service interruptions due to non-pay)

- LW = Late Weight

The equation creates a score, similar to a credit score by factoring the relative weight of each attribute. With the formula above, we established a the following weights to examine the distribution of customer scores:

- Spend Weight = 1

- Tenure Weight = 10

- Late Weight = 3

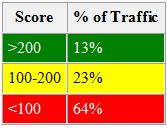

This creates a distribution with scores between falling into ranges listed below:

Volume, AHT and Capacity Assumptions

Score Distribution

AHT & Volume

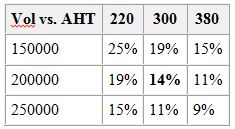

The tables below identify the percentage of calls which are able to be handled by the internal group, based on a 80% OCC and 30% Shrinkage

Wide variations exist today for forecasting Volume and AHT. Below is a matrix for volumes between 150k-250k/month, with AHTs from 220-380. The percentages values represent what portion of the call volume could be handled in-house with an initial team of 24 CAEs.

A volume vs. AHT mix of 200k calls w/ 300 sec AHT would allow 24 agents to capture the customers with >200 Score.

Collections Cost Per Call Calculator

The Collections Cost Per Call Calculator was developed to be used in modeling the Southern Division's strategy for introducing attribute routing for calls which originate from a service interruption being initiated to collect payment.

This calculator allows call volumes to be segmented into three buckets, assuming the application of attributes to route calls. Once attributes are applied, and volumes identified, the calculator allows different AHT, Occupancy and labor costs to be applied in order to determine a cost per call by segment, as well as a blended cost per call.

This calculator assumes a basic premise that "High Value" calls are contained with an "internal labor rate" and that "Low Value" calls are contained with an "external labor rate". For the "Medium Value" segment, there is a slider which allows you to segment these calls to any % of resources associated with the internal or external labor rate.

The calculator has you dial in the high value and medium value buckets, with low value calculating the balance based on the two higher segments.

Ted Lango